📅 Date: April 5, 2025

🗳️ Author: The Centrist

🌐 Published at: CentristDaily.com

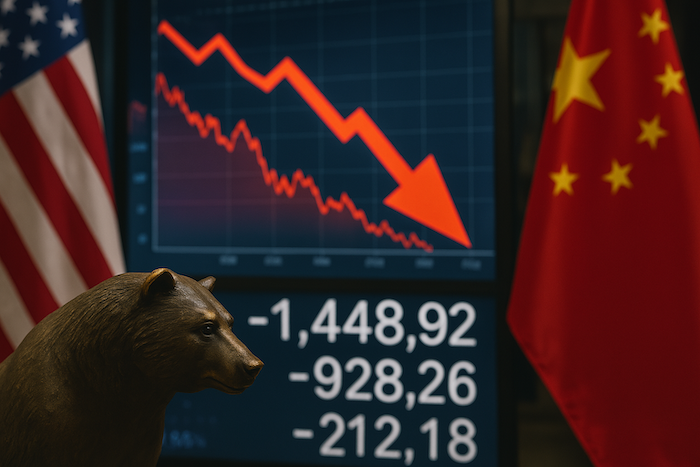

⚡️ Tariff Earthquake: Markets Are Imploding

In the aftermath of Liberation Day, U.S. markets have nosedived. Fears of China’s retaliatory tariffs are shaking investor confidence as companies heavily reliant on global supply chains suffer severe losses.

🔥 Market Meltdown This Week:

| Index | Drop (Points) | % Drop |

|---|---|---|

| ⬇️ Dow Jones | -2,220 | -6.4% |

| ⬇️ Nasdaq | -1,105 | -7.1% |

| ⬇️ S&P 500 | -285 | -6.8% |

⚠️ Sectors hit hardest: Technology, automotive, semiconductors, agriculture.

🤔 “Is this a temporary correction or the start of something bigger?”

🌎 Global Fallout: When Do Countries Cave?

🌺 China has already announced counter-tariffs hitting:

- U.S. soybeans 🌾

- Semiconductor components 🛠️

- Aerospace parts ✈️

- Electric vehicles ⚡️

⌛ What’s the Timeline for Tariff Reversals?

| Country | Retaliation Announced? | Negotiation Timeline | Chance of Caving Soon |

|---|---|---|---|

| 🇨🇳 China | ✅ Yes | 2-4 months | ❌ Unlikely |

| 🇩🇪 EU | ✅ Yes | 1-2 months | ❓ Possible |

| 🇰🇷 Japan | ✅ Yes | <1 month (quiet talks) | ✅ Likely |

| 🇨🇳 Canada | ❌ No | N/A | ✅ Already cooperating |

🤞 Hope lies in bilateral negotiations, but that could take weeks to months, not days.

Centrist Analysis: Policy Without Clarity

While Democrats rage and Republicans rally, centrists are left saying:

🤔 “This could work—but where’s the roadmap?”

- There’s no detailed plan from the White House outlining trade negotiation goals or economic mitigation strategies.

- The lack of transparency is fueling market panic.

- Centrist lawmakers are urging for a public briefing and timeline to help stabilize markets.

🔎 What’s Needed:

- Clear benchmarks for success ✉️

- Timeline for reassessment ⌚

- Regular public communication 📰

🪙 What Should Investors Do?

With portfolios shrinking and panic growing, here’s how to navigate the storm:

🌟 1. Stay Calm, Stay Long (If You Can)

- History shows markets recover. The 2008 crash was followed by a historic bull run.

- Selling now locks in losses. ❌

💼 2. Rebalance Portfolios

- Reduce exposure to high-risk international stocks

- Add to U.S. dividend-paying stocks and utilities

- Diversify into commodities (e.g., gold, silver)

📈 3. Move to Safe Havens

| Asset | Why |

|---|---|

| 🥇 U.S. Treasuries | Low-risk, liquid investment |

| 🥁 Gold | Holds value in crisis |

| 🌴 Money Markets | Preserve capital with stability |

📅 4. Evaluate Retirement Accounts

- Keep contributing to your 401(k) for long-term benefit

- Consider Roth IRA conversions while market is low

- Adjust your asset allocation if you’re near retirement

🚳 Don’t panic move your 401(k) to all bonds unless retirement is within 3 years.

🌐 What Could Happen Next (Scenarios)

🔥 Worst Case – Trade War Escalates

- Global recession

- 20-30% equity market drawdown

- Job losses in trade-heavy sectors

🚀 Best Case – Negotiations Work

- Countries agree to lower tariffs

- Trade balances improve gradually

- Stocks bounce back with relief rally

⏳ Most Likely – Pain Before Progress

- Volatility persists for 2-4 months

- Gradual realignment of global trade

- U.S. inflation ticks higher ⬆️ short term

🛎️ Final Word: Wisdom in the Middle

Whether you support Trump’s tactics or fear his lack of foresight, everyone agrees we’re in a high-stakes gamble.

🕵️♂️ “The key isn’t panic—it’s planning.”

As a centrist, I urge:

- The administration: be more transparent

- Lawmakers: protect the people, not just politics

- Citizens: stay informed, diversified, and prepared

💬 Join the Conversation

📢 How are you adjusting your investments? Tag us @CentristDaily and let us know.

🌐 Read our full coverage at CentristDaily.com

🌊 Stay centered. Stay smart. Stay strong.